Dubai General Trading License Guide

Download

IFZA Official

Guides

-

Company formation in Dubai (2023): an insider’s guide

Download the guide -

How to become an IFZA professional partner

Download the guide

UAE Corporate Tax: Everything You Need to Know

In January 2022, the UAE government announced the implementation of a new corporate tax. Previously, taxes were not imposed on corporate profits, except for a few industries like resource extraction and foreign banks. Starting from June 1st, 2023, many more businesses operating in the UAE will be subject to the 9% corporate tax rate. While not all businesses will be affected by this new tax, it is important to understand its implications and how it may impact your organization.

Why has UAE Introduced Tax on Corporate Income?

The introduction of taxes on corporate income in the UAE serves several important purposes.

-

01.Enhance UAE’s Status and Reputation as a top Business Destination

It aims to enhance the country’s status as a leading commercial and investment destination. By adopting taxation policies like those found in other developed economies, the UAE can offer greater transparency and stability to investors, making it an even more attractive place to do business.

-

02.Accelerate UAE’s Development and Strategic Objectives

In addition to attracting investment, the introduction of taxes on corporate income can help accelerate the country’s development and achieve strategic objectives. The revenue generated from corporate taxes can be used to fund critical infrastructure projects and public services, which can benefit both businesses and residents of the UAE.

-

03.Comply with Global Tax Standards and Promote Transparency

The implementation of corporate taxes is also in line with international standards of tax transparency. The UAE has committed to working with other countries to improve global tax practices and reduce the risk of tax evasion and other harmful practices. By introducing corporate taxes, the UAE is demonstrating its commitment to being a responsible and compliant member of the international community.

-

04.Eliminate Harmful Tax Practices

Another key benefit of corporate taxation is the elimination of harmful tax practices. In the past, some companies in the UAE may have used tax loopholes or other strategies to avoid paying their fair share of taxes. The introduction of corporate taxes helps to level the playing field and ensures that all businesses are contributing their fair share to the economy.

-

05.Reduce UAE’s Reliance on Oil Revenue

Finally, the introduction of corporate taxes is intended to reduce the UAE’s reliance on oil revenue. As the country looks to diversify its economy and develop new sources of income, corporate taxes can help to create a more sustainable revenue stream that is less dependent on fluctuating oil prices. By reducing its dependence on oil, the UAE can build a more resilient and robust economy that is better equipped to withstand economic challenges in the future.

When Will the Corporate Tax Come into Effect?

The corporate tax will come into effect from the beginning of their first financial year which starts on or after June 1, 2023.

If your company’s fiscal year starts on June 1 st , 2023, and ends on May 31 st , 2024, you will be subject to CT starting June 1st, 2023, and your first tax return filing will be due in the end of 2024. If your company’s fiscal year starts on January 1st, 2023, and ends on December 31st, 2023, CT will start on January 1st, 2024, and filing will be due in mid 2025.

How Does UAE Corporate Tax Compare to Other Countries?

UAE is known to be one of the most tax-friendly countries, as many other countries impose high corporate income tax on businesses. These corporate tax rates can vary significantly. Here’s how the UAE’s 9% corporate tax rate compares to leading global trading centers.

According to reports, South America has the one of the highest regional average rates, at 31.03%. Africa comes in a close second with 29.74%, keeping Europe at 23.97% and Asia at 19.62%.

The corporate tax rate in India and Australia stands at 34%, 29.9% in Germany, 29.74% in Japan, 26.47% and in Canada, 25.75%.

-

01.Australia – 34%

-

02.New Zealand – 28%

-

03.Korea – 25%

-

04.Norway – 22%

-

05.United States – 21%

-

06.Sweden – 20.6%

-

07.United Kingdom – 19%

-

08.Singapore – 17%

-

09.Hong Kong SAR, China – 16.5%

-

10.Georgia – 15%

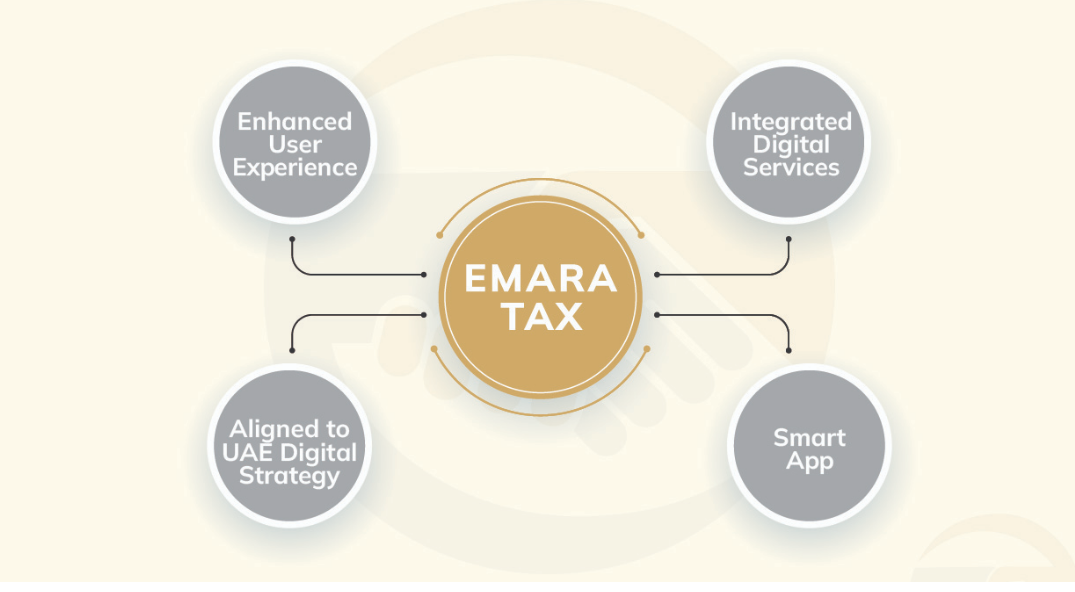

What is Emara Tax?

Emara Tax is a digital platform launched by the Federal Tax Authority (FTA) in the United Arab Emirates to enable taxpayers to pay their tax obligations, obtain refunds, and access related services securely and conveniently.

What Can Emara Tax Help With?

The Emara Tax platform, as per the FTA’s regulations, provides access to a total of 119 tax services in the UAE, surpassing the current FTA portal by 84 services. With Emara Tax, you can enjoy a broad spectrum of tax services, including tax registration, tax deregistration, tax return filing, tax payments, tax refunds, and many more. Key services include:

-

01.You can easily access the E-service portal using an Emirates ID and UAE Pass.

-

02.The ‘Edit’ option allows you to quickly update all bank account details.

-

03.All users will get reminder notifications to ensure timely document updating.

Will Companies Be Invited to Register on Emara Tax?

The MOF has announced that early registration for certain categories of companies will be open from January to May 2023. The selected companies will receive an email or SMS from the FTA inviting them to register through the Emara Tax platform. Registration for other companies and businesses has not been announced yet by the FTA. When the registration process starts, companies and businesses with a financial year starting on 1st June 2023 will be given priority. Companies that register early will have more time to familiarize themselves with the new tax system and ensure compliance with the regulations.

Who Will Be Subject to Corporate Tax in the UAE?

According to the Federal Tax Authority (FTA), Corporate Tax in the UAE applies to a variety of entities, including companies and individuals, both resident and non-resident.

-

01.UAE Companies and Juridical Persons

Corporate Tax applies to all UAE companies and other juridical persons that are incorporated or effectively managed and controlled in the UAE. These entities must comply with the requirements set out in the Corporate Tax Law.

-

02.Natural Persons (Individuals)

Individuals who conduct a business or business activity in the UAE are also subject to Corporate Tax as specified in a Cabinet Decision that will be issued in due course.

-

03.Non-Resident Juridical Persons (Foreign Legal Entities)

Non-resident juridical persons that have a Permanent Establishment in the UAE are subject to Corporate Tax. Permanent Establishment is explained in section 8 of the law.

Juridical Persons Established in UAE Free Zones

Juridical persons established in a UAE Free Zone are also subject to Corporate Tax as ” Taxable Persons.” However, a Free Zone Person that meets the conditions to be considered a Qualifying Free Zone Person can benefit from a Corporate Tax rate of 0% on their Qualifying Income. The conditions for Qualifying Free Zone Person status are included in Section 14.

Withholding Tax in the UAE

Non-resident persons that do not have a Permanent Establishment in the UAE or that earn UAE sourced income that is not related to their Permanent Establishment may be subject to Withholding Tax at a rate of 0%. Withholding Tax is a form of Corporate tax collected at source by the payer on behalf of the recipient of the income. It applies to cross-border payment of dividends, interest, royalties, and other types of income, and exists in many tax systems worldwide.

Who is Exempt from Corporate Tax?

In the UAE, some businesses or organizations are exempt from Corporate Tax due to their significant contributions to the social fabric and economy of the country. These entities are called Exempt Persons and may include:

Apart from being exempt from Corporate Tax, certain entities such as Government Entities, Government Controlled Entities as specified in a Cabinet Decision, Extractive Businesses and Non-Extractive Natural Resource Businesses can also be relieved from any registration, filing, and other compliance obligations stipulated by the Corporate Tax Law, provided they do not engage in activities that fall under the purview of Corporate Tax.

Corporate Tax and Free Zone Companies in the UAE: What You Need To Know

The introduction of corporate tax in the UAE has raised questions about how this will affect businesses that operate in Free Zones. While it is not yet clear how the new tax will apply to these companies, there are a few important factors to consider:

Pre-Agreed Incentives for Free Zones

According to the government announcement, free zone companies will still be able to benefit from the advantages provided by their own specific free zone’s pre-agreed incentives. These may include tax-free periods of up to 50 years, exemption from customs duties, and 100% foreign ownership.

Possible Future Changes to Free Zone Rules

While free zone companies are currently not subject to corporate tax, it is possible that this may change in the future. Free zones could potentially introduce the tax, so it’s important for companies to stay up to date with any announcements or changes.

Corporate Tax on Revenues Generated from Mainland Businesses

If free zone companies do business with mainland businesses, they will normally have to pay the corporate tax on revenues generated by working with them. It is important for companies to understand the specific requirements for their business and to keep track of any updates or guidance provided by the Ministry of Finance and the Federal Tax Authority.

Corporate Tax Registration and Filing

Free zone companies will also need to register and file a corporate tax return, even if they do not have to pay any tax. It is important for companies to understand the specific requirements for their business, such as the need to register, the accounting/tax period, the filing deadline, and any necessary elections or applications.

Will Tax Holidays Continue to Apply to Free Zone Entities?

Certain Free Zones in the UAE provide tax-free incentives for up to 50 years. The UAE Ministry of Finance confirms that these tax incentives will continue for free zone entities that adhere to the relevant regulatory requirements and do not engage in business with mainland UAE.

The definition of “conducting business with mainland UAE” is uncertain at this time, and it is unclear whether certain situations, such as contracting with onshore customers and earning income from mainland UAE, would qualify as conducting business with mainland UAE. Although free zones are treated differently for VAT purposes, the Ministry of Finance clarifies that a consistent treatment will apply for CT purposes across all free zones.

Further information on how free zone entities will be treated is expected to be provided in the future. It is also uncertain whether free zones will renew tax incentives after they expire.

How Can You Prepare for Corporate Tax in the UAE?

To prepare for corporate tax, it is important to take the following steps:

-

01.Understand the Corporate Tax Law and Additional Information

To prepare for Corporate Tax, it is essential to understand the Corporate Tax Law and any additional information provided by the Ministry of Finance and the Federal Tax Authority. This information can be found on their websites or by contacting them directly. Familiarizing yourself with the requirements will help you understand what you need to do to comply with the law and avoid penalties.

-

02.Determine if Your Business is Subject to Corporate Tax

Use the information available to determine whether your business is subject to Corporate Tax and when it will be effective. Corporate Tax applies to most businesses in the UAE, except for those that are exempt or have a specific tax status. To determine whether your business is subject to Corporate Tax, you can review the UAE tax laws and guidelines or seek professional advice.

-

03.Understand Specific Requirements for Your Business

Each business has its specific requirements for Corporate Tax, such as the need to register, the accounting/tax period, the filing deadline, and any necessary elections or applications. Understanding these requirements will help you comply with the law and avoid any penalties. Ensure you understand the deadlines for filing your Corporate Tax returns and making any tax payments.

-

04.Keep Track of Updates and Guidance

The Ministry of Finance and the Federal Tax Authority regularly update their guidelines and provide further guidance on Corporate Tax. Keep track of any updates or guidance to ensure you are aware of any changes in the law that may impact your business. This will also help you stay compliant with the law.

-

05.Maintain Financial Information and Records

It is essential to maintain accurate financial information and records that are required for Corporate Tax purposes. This includes keeping records of all transactions, expenses, and income. Keeping organized records will help you file your Corporate Tax returns accurately and quickly. Additionally, it is important to keep your financial information and records for at least five years, as they may be required for any audits or disputes.

Will You Still Have to Pay VAT with Corporate Tax in the UAE?

In the UAE, both Corporate Tax (CT) and Value-Added Tax (VAT) will be applicable taxes. It is important to note that they are separate taxes, and businesses will be required to pay them separately. This means that if your business is already registered for VAT, you will need to continue paying both taxes.

However, if your business is not registered for VAT, you may still be liable to pay CT. It is important to understand the specific requirements for both taxes and ensure that your business is compliant with all relevant laws and regulations. Keeping accurate financial records and seeking professional advice can help you manage your tax obligations effectively.

Corporate Tax Related Knowledge Events with IFZA

As Dubai’s most dynamic and truly International Free Zone, IFZA is committed to supporting the community’s compliance with the latest regulation. We began the implementation of several activities that aimed to empower members to face the upcoming changes to our business ecosystem. If you have any questions stay tuned to our website for future additions of CT- related knowledge events.